Different people have different concepts of what struggling with money really means. Some people are thankful that they earn enough to cover their rent, utilities, and food expenses for the month. Others are glad that they have enough to buy one solid meal a day. While still others earn millions, can buy anything and everything their hearts desire, but feel as though they never have enough.

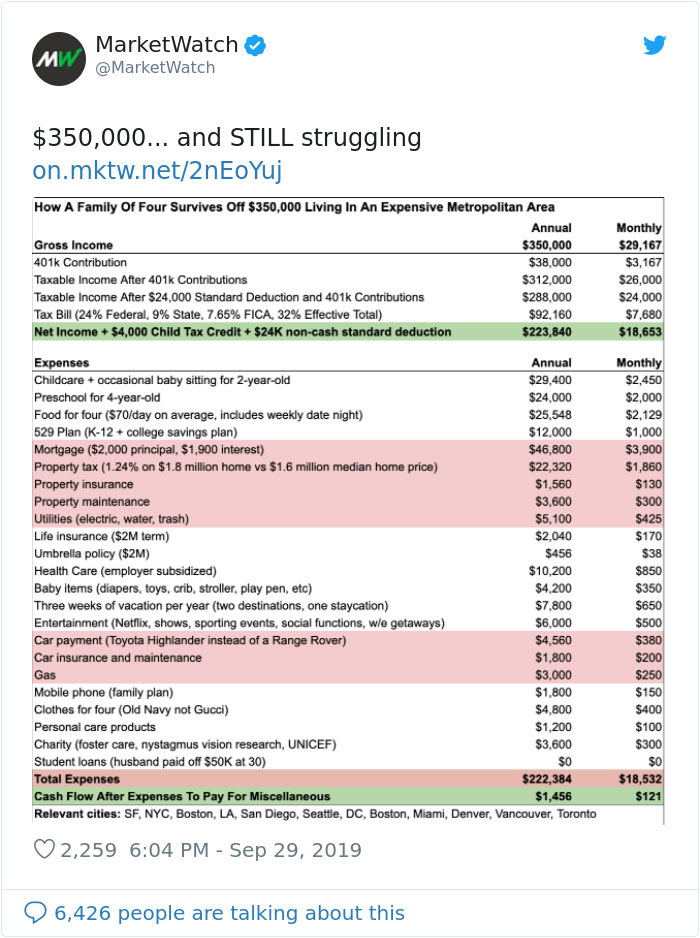

Twitter had a field day making fun of a supposedly financially struggling family that had an annual gross income (that’s before taxes) of 350,000 dollars. Twitter users were ruthless with their jokes, stating how the only thing that family might be struggling with is probably math, while others criticized the family’s flamboyant lifestyle.

This claim about how earning $350k a year is supposedly ‘struggling’…

Image credits: MarketWatch

It all started with an article and a tweet published by MarketWatch, which used data collected by Sam Dogen on the Financial Samurai blog, about how a budget shows that an annual 350,000 dollar salary “barely qualifies as middle class.”

The budget that Dogen created has some strange things in it, like three weeks of vacation, spending 400 dollars a month on clothes from Old Navy, and dropping 2000 dollars a month on preschool. This, to most people, doesn’t look like the budget of a ‘struggling’ family that’s barely getting by.

“Unfortunately, despite making $350,000 a year, this couple will be unable to retire before 60 because they aren’t building an after-tax investment portfolio to generate passive income,” Dogen writes on his blog. “In order for this couple to achieve financial independence, they need to accumulate a net worth equal to at least 25 times their annual expenses — or 20 times their annual gross income.”

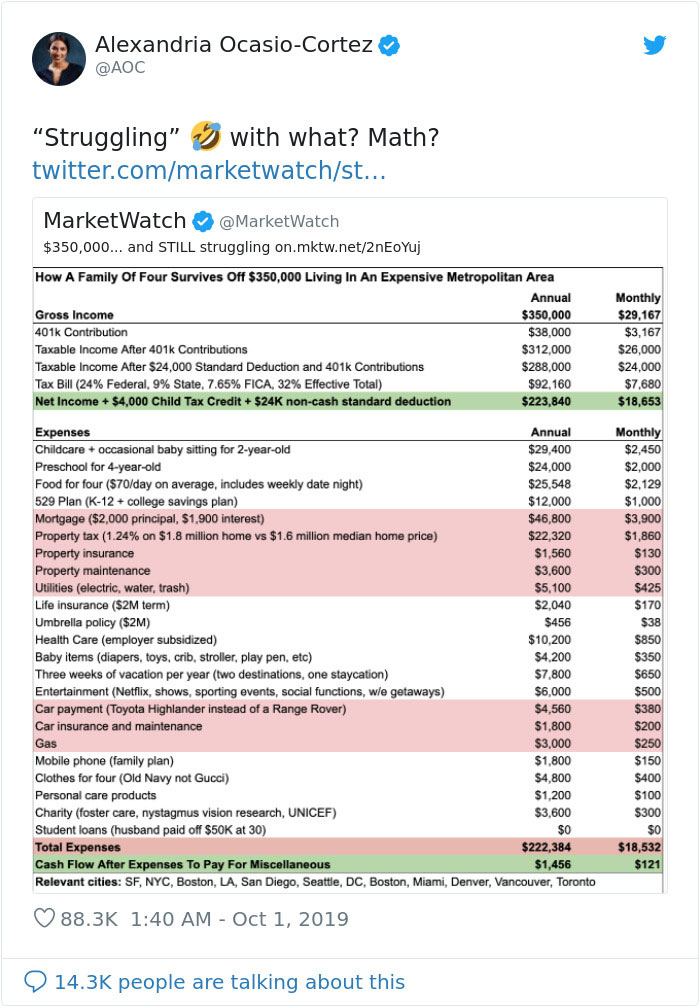

…caught Twitter users’ attention, including that of Alexandria Ocasio-Cortez

Image credits: AOC

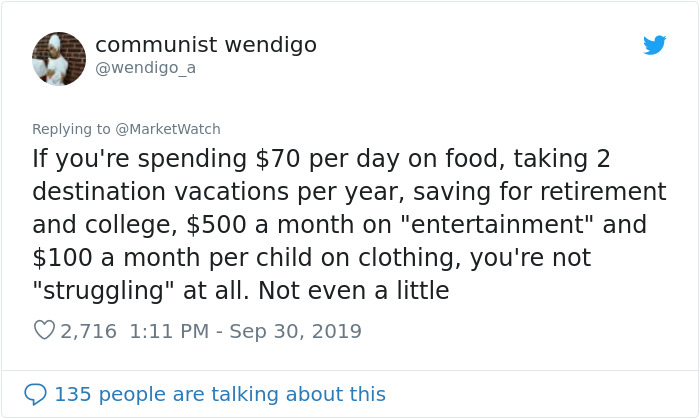

Image credits: wendigo_a

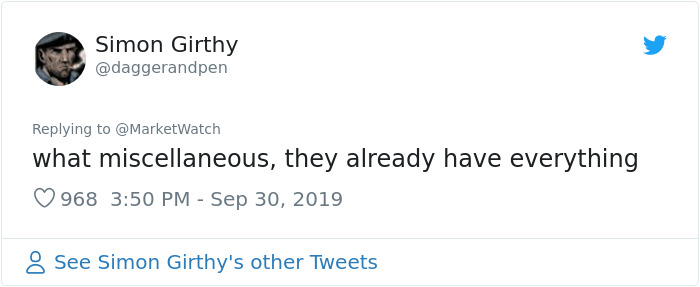

Image credits: daggerandpen

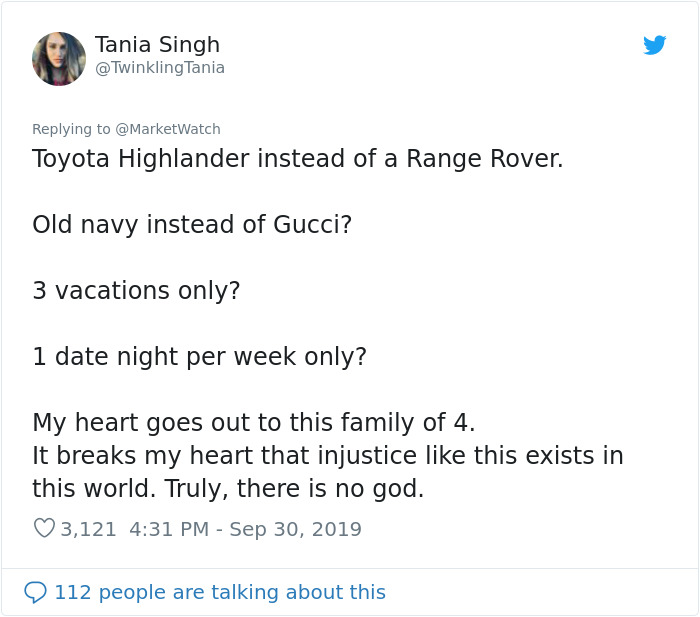

Image credits: TwinklingTania

Whatever your financial situation at home, there’s always something you can do to save money for a rainy day, pay off debt, and save for college. Discover suggests that families focus on food costs by planning in advance, buying what’s on sale, and having a very clear cash limit.

Another way to save money is to make important events like birthdays a simple affair, like a day at the beach or having a sleepover with pizza and cake. Then there’s the question of clothes. Most parents want their kids to wear the very best brands, but it makes little sense to buy expensive clothes that your kids will grow out of in a matter of months. It’s worth considering going for second-hand clothing. Do you have any advice on saving money, dear Readers? Share the tips that have worked for you in the comments.

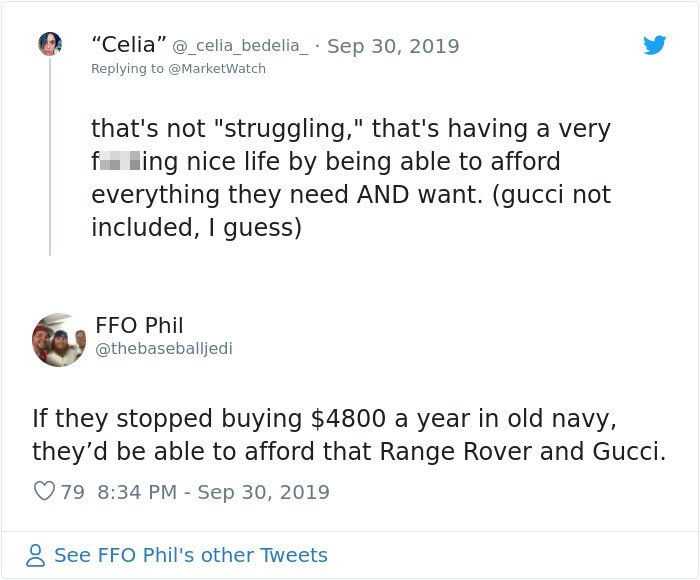

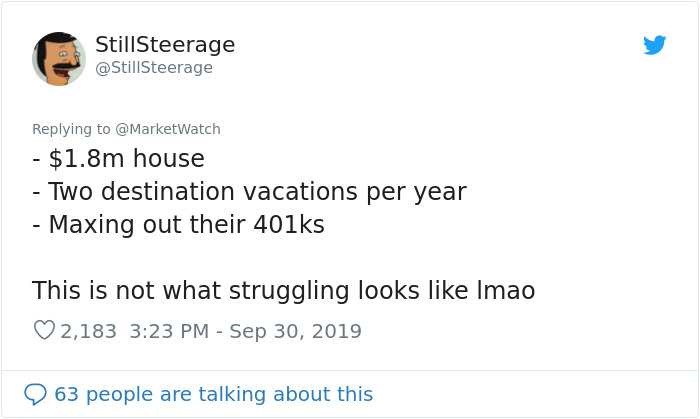

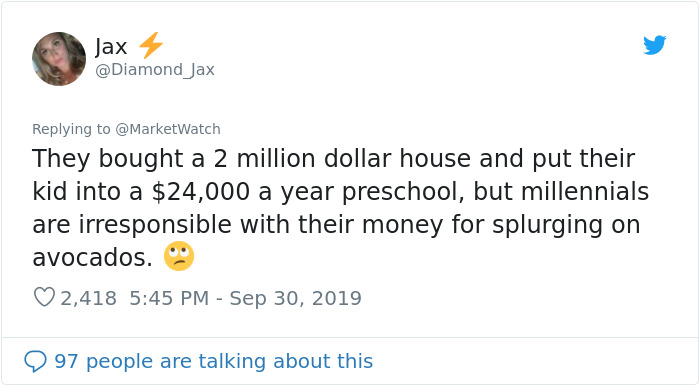

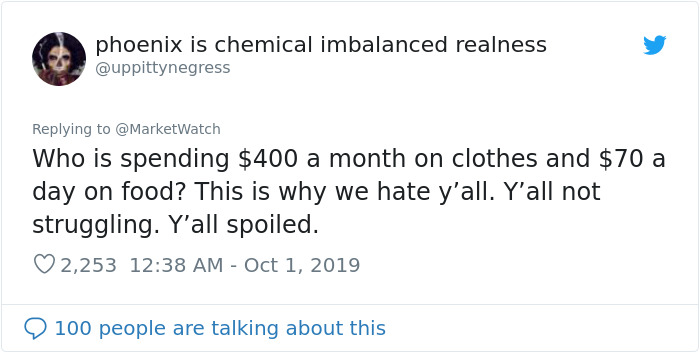

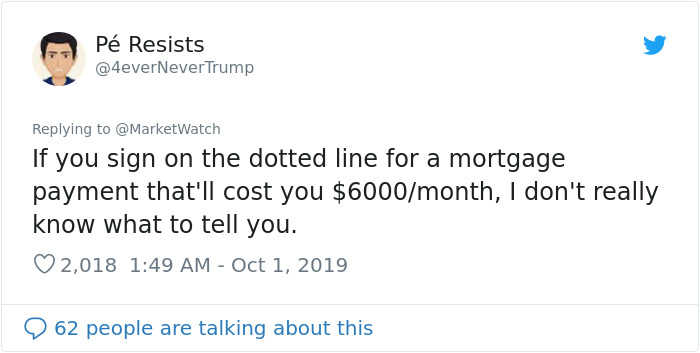

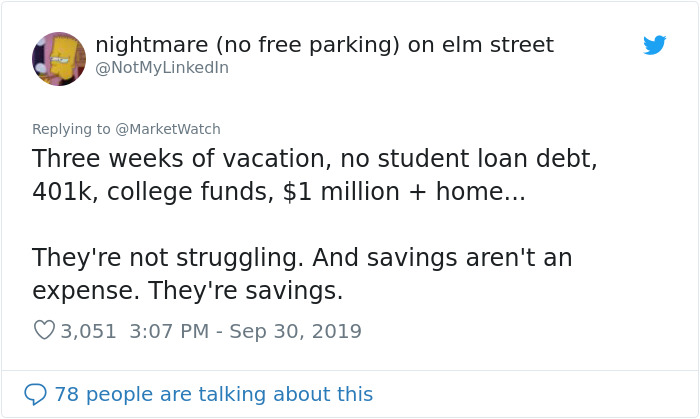

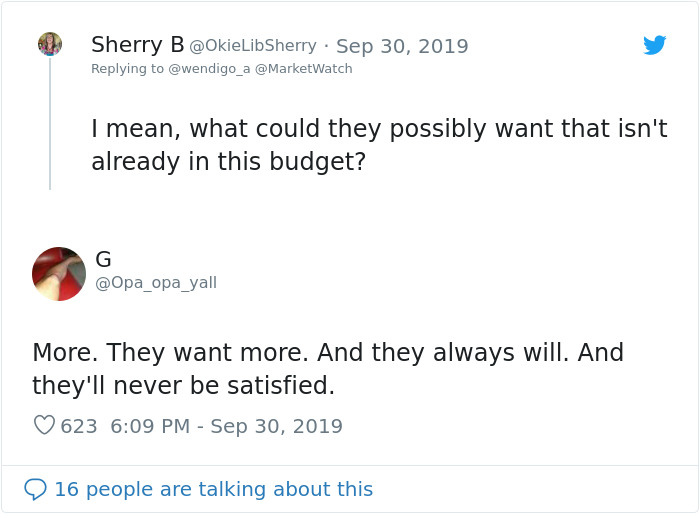

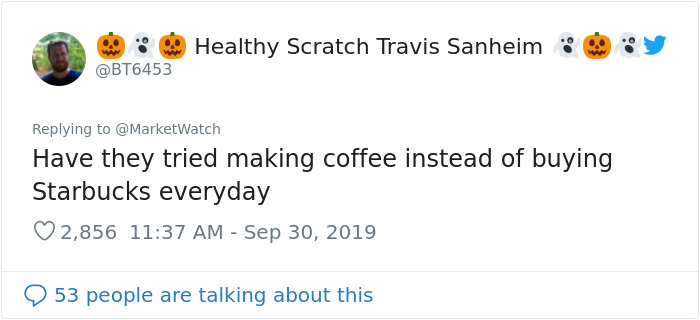

Other people expressed their opinion without any reservations

Image credits: thebaseballjedi

Image credits: StillSteerage

Image credits: Diamond_Jax

Image credits: uppittynegress

Image credits: 4everNeverTrump

Image credits: kamilumin

Image credits: NotMyLinkedIn

Image credits: heymanmyband

Image credits: Opa_opa_yall

Image credits: BT6453

Image credits: big_buttlefish

by Jonas Grinevičius via Bored Panda - Source

No comments: